SEC Modifications and Disclosures for Private Banks

Bain Funding’s acquisition of Accuride gave it much more sources than it got from Bridgestone/Firestone. The company constructed a brand-new, automatic manufacturing center to decrease its per-unit expenses as well as allow it damage the competitors. Numerous competitors can not react quickly as a result of their investors’ concentrate on quarterly results.

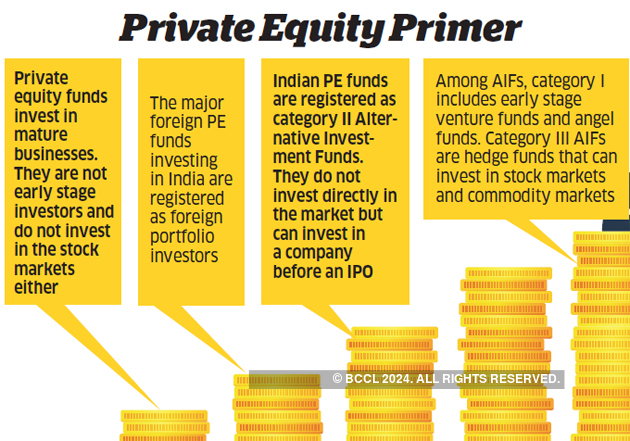

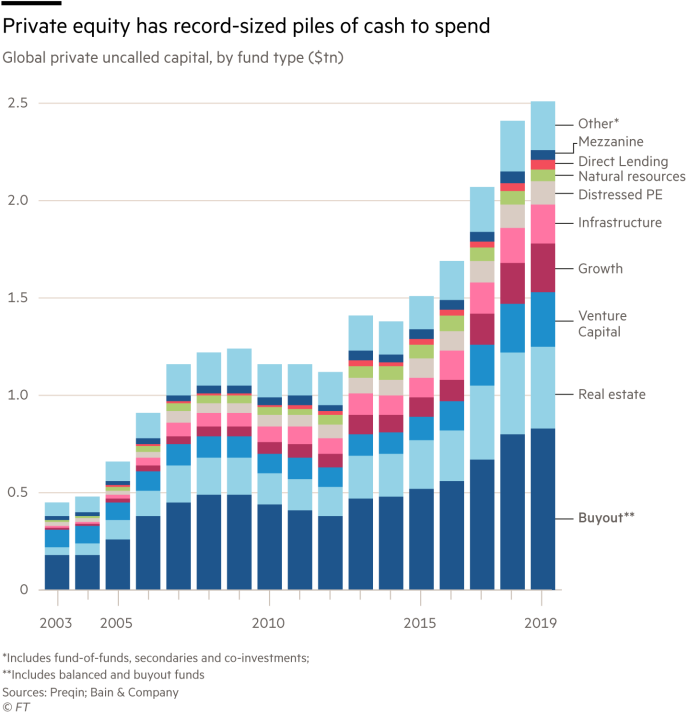

Private-equity investors such as Tyler T. Tysdal, typically syndicate their transactions to various other purchasers to attain benefits that consist of diversity of different kinds of target danger, the combination of complementary capitalist information as well as skillsets, and a boost in future bargain flow. Private equity is a type of equity and one of the possession classes consisting of equity securities as well as debt in operating companies that are not publicly traded on a stock market. Resources commitment is the quantity of money a firm is anticipating to spend over an amount of time on certain long-lasting assets or to cover future obligation. A captive fund is a pooled investment readily available just to a select team, frequently participants of a particular company or company. No investment must be made without correct factor to consider of the dangers and also suggestions from your tax, accounting, legal or various other experts as you deem proper. A monthly publication featuring the International Multi-Asset Team’s most current sights on the economic as well as market atmosphere and how ideal to place profiles.

Regulationnyse National.

For example, one DFI constructed the following classification of TA dangers to examine financing choices as well as design the administration process for using a TAF. Provides a comprehensive overview to establishing as well as running hedge funds, covering all the vital legal, regulatory, and also tax obligation issues that require to be thought about and covered when establishing a fund. The new second edition is totally upgraded to cover the AIFMD and the Dodd Frank Act in the United States. Consists of info on PE as well as VC business and also funds, portfolio companies as well as broad industry data. Each administrative chapter provides extensive information of the regulative concepts, lawful frameworks and limitations, as well as typical service options for funds, debt money, equity structures, departures as well as tax obligation. Provides a thorough catalog of the common conditions in investment fund and also private M&A records. It interprets common tax language as well as offers instances of various drafting strategies.

check Out The Sec Law Firm.

For more details, see our insurance coverage of private equity vs. venture capital. our premier online brokers for buying ETFs and various other index funds. However, the report likewise keeps in mind that given that 2009, returns for the public and also private markets have been about the same, at an annual standard of around 15%. Looking in advance, professionals think the coronavirus will adversely influence offer task and also private equity returns in the temporary, and the lasting impacts of such an unmatched event are still unidentified. Traditional private equity is booked for certified investors, but there are various other means to invest in this alternate asset. Typical difficulties in carrying out TA include problem raising funds to support it and also a dearth of quality experts or service providers to implement on the required solutions. One factor possibly restricting the amount of funding available for TAFs is the regarded threat that TA usage will misshape markets.

Inspect The background Of Your Financial expert

Associate work consists generally of study, due diligence, monetary modeling, and report writing. Like analysts as well as associates in an investment bank, if they aren’t experts at preparing spread sheets in Excel when they show up, they end up being specialists not long after getting here.

buy private equity real estate in behalf of organizations such as those noted above. An additional group of individuals fall under this category, though they might similarly be at home in both the private financier or institutional groups– the team of ultra-high-net-worth individuals or family offices. Keep reading for your supreme guide to purchasing private equity real estate. We manage financier communications– including funding phone calls, distributions, and monetary statements– via our safe and secure, exclusive Point of view ™ financier portal. We take care of intricate private-capital fund reporting and make reports and also statements readily available to your investors with our safe, proprietary Perspective ™ financier website. We serve Private Equity Funds with a high-touch method to service, and also a best-of-breed innovation platform to support you and also your investors.

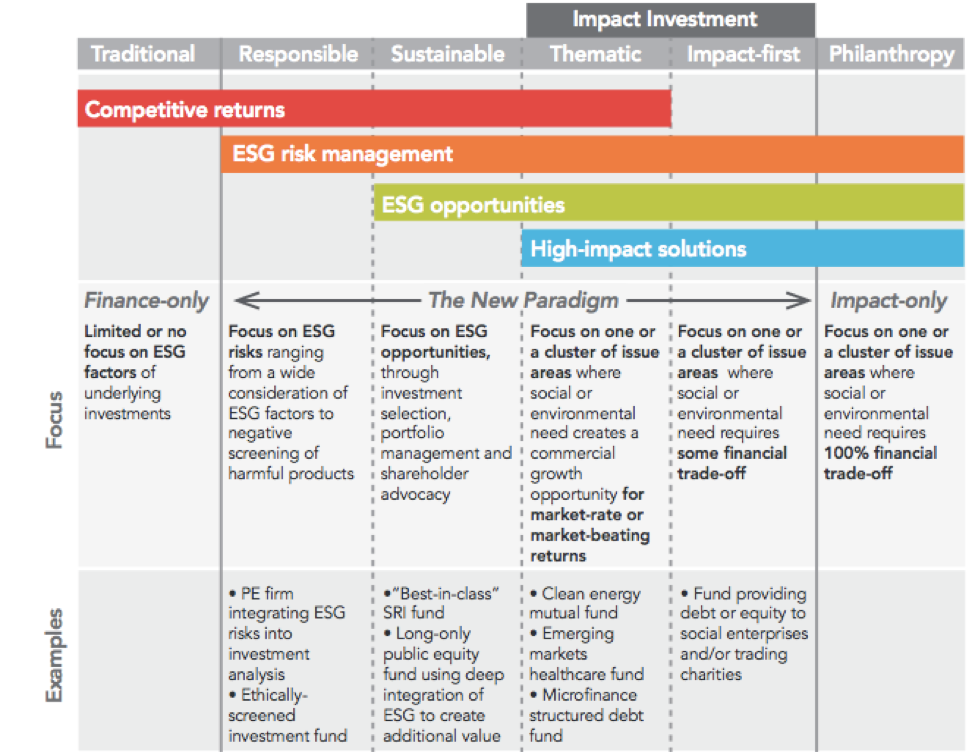

As opposed to being viewed as an industry that focuses on making operations leaner through discharges and restructuring, PE companies are starting to be seen as having the ability to aid suffer and construct business, as well as boost work levels. PE firms are making a conscious effort to buy even more socially responsible business. An occupation secretive equity can be extremely satisfying, both monetarily as well as directly.

With US$ 995bn under management, we represent 20% of the bush fund industry, computing greater than 250,000 fund NAVs per month. Our proceeded monetary commitment to modern technology investment allows us to supply the alternative investment industry with versatile , safe and also robust systems. We arrange funds’ yearly, quarterly, and/or monthly unaudited financial statements in consistency with the relevant bookkeeping requirements (UNITED STATE GAAP/ IFRS).

If the borrower defaults on the financing, then the loan provider normally can take the particular properties securing the car loan. Safe financial obligation is senior in concern to unsecured financial obligation in the event of a bankruptcy. A “recapitalizationi” is a restructuring of a firm’s capital framework (the firm’s mix of equity and financial obligation).

The trick is to be discerning as well as to target your strategy, advertising and marketing message, and also framework to your chosen target market. Functional problems are additionally extra tough in the fund context, where the task of determining, examining, as well as handling investments is no more one that can be handled by the manager alone, as well as having a professional staff becomes essential. Considering the lawful structure of a fund, there are numerous related entities as well as directional circulations of money that should be plainly recognized prior to starting out. The image listed below programs an instance of a common private equity fund framework. A fund framework permits a supervisor to accessibility financial obligation instruments that can enhance its series of investment chances. Increased monitoring fees are credited portfolio companies by advisors for the consultant providing board and also various other advisory solutions throughout the portfolio companies holding period. Although most portfolios are not held for longer than 5 years, monitoring fees may last 10 years or longer, and are generally instantly renewed annually.

Spread sheets and non-integrated applications are just not going to get the job done. From the back workplace to capitalist relations to deal monitoring, Allvue’s fully incorporated suite of solutions has whatever a Private Equity General Practitioner requires to run their operations and also businesses efficiently– regardless of size or approach. Integrated in combination with Microsoft’s business solutions, Allvue produces Exclusive Equity-specific technology that powers most of the globe’s most effective fund supervisors. Private equity is an umbrella term for large quantities of money increased straight from recognized individuals as well as establishments and pooled in a fund that invests in a series of service ventures. Tyler Tysdal, Denver entrepreneur and cofounder of Freedom Factory has been in the business for over 20 years.

Troubled or turn-around circumstances– utilized when companies are incapable to service their existing debt, as well as the fund’s equity is utilized to recapitalize the annual report in addition to monitoring carrying out a turn-around strategy. There are various kinds of limited partners, ranging from large foundations as well as establishments to high total assets people. As the graph listed below shows, there is no excessively dominant resource of funding, and it is feasible to be effective concentrating on a selection of resources of funding.

PE companies can invest in a broad mix of personal investment methods, with the mix varying greatly from firm to firm relying on the firm’s size, stated investment technique, as well as market and transaction competence. The public has begun to see how acquistions can play a helpful duty in improving business as well as enduring economic development.